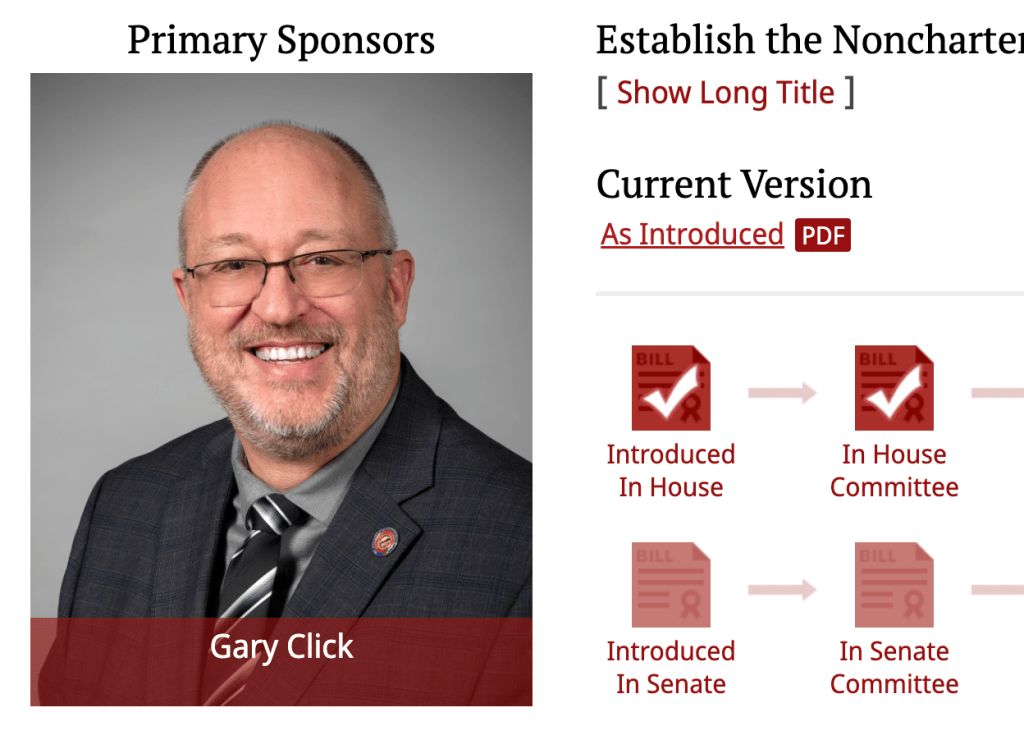

Rep. Gary Click claims House Bill 339 is fixing an oversight in Ohio’s school voucher program. The exclusion of non-chartered nonpublic (NCNP) schools was not an oversight. It was done intentionally and should remain that way.

Rep. Click discusses in his testimony how these NCNP schools choose to not accept tax money in exchange for no direct regulation.

“These are schools that, for religious reasons (i.e. separation of church and state,) choose not to receive direct funding nor accept direct regulation from the state.”

This is the schools choice. But then he says that HB 339 is not funding schools but funding families, that then choose to send it to the schools. This statement is not true in any way. The bill states

“(1) The treasurer of state shall disburse funds directly to a participating school that complies with the requirements prescribed under section 3310.25 of the Revised Code.”

This clearly states the funds will go from the state, to the schools. Remember, this is a direct contradiction to the statement Rep. Click made in his testimony.

“These are schools that, for religious reasons (i.e. separation of church and state,) choose not to receive direct funding nor accept direct regulation from the state.”

HB 339 also allows families to spend tax payer money on additional goods or services. The additional items that can be reimbursed for are:

- Tutoring or intervention services by an individual or educational facility, provided that the services are not provided by an immediate family member of the student;

- Educational services including occupational, behavioral, physical, speech-language, and audiology therapies;

- Curriculum, textbooks, instructional materials, and supplies;

- Fees for after-school and summer educational programs.

The current school voucher program does not pay for any additional expenses for students of public or chartered schools. Not tutoring, not after school programs, not summer programs, not therapies, nothing. HB 339 has added additional items that no other child in Ohio receives through the voucher program.

There is also a text credit that NCNP fame’s can take from $500-$1,000 based on income. https://codes.ohio.gov/ohio-revised-code/section-5747.75

There is also the issue with Rep. Gary Click being the pastor at Temple Christian Academy, which is an NCNP school. Rep. Click has spoken about how his goal was and is to turn around the financial situation at the school. HB 339 would definitely help with that endeavor. Here’s the language from Rep. Click’s website.

This seems like a conflict of interest with funds from HB 339 going directly into the school that Rep. Click is employed at.

Rep. Click and the NCNP schools have said that the tax money they choose to not receive, they actually want now, still with no regulations. But, now they want to add additional things families of NCNP schools can use tax payer money on that no other family in Ohio can. This bill contradicts itself and adds special privileges for families who choose to enroll in an unchartered school.

View the highlighted version of the bill here.